What to Search for in a Reliable Insurance Service Provider Prior To You Purchase

What to Search for in a Reliable Insurance Service Provider Prior To You Purchase

Blog Article

Exactly How Family Pet Insurance Coverage Can Help You Conserve on Veterinary Prices

Family pet insurance coverage works as a calculated economic tool for family pet owners, dealing with the unforeseeable nature of vet expenditures. By giving protection for both crashes and diseases, these policies can dramatically mitigate the expenses related to needed medical therapies. This not only cultivates a sense of safety and security for owners however also promotes proactive health and wellness management for their family pets. However, recognizing the nuances of different strategies and the potential long-term savings calls for careful consideration. What variables should family pet proprietors prioritize when examining their choices?

Understanding Family Pet Insurance Policy Essentials

How can pet dog insurance policy relieve the financial burden of unexpected vet costs? Family pet insurance coverage offers as an economic safeguard for pet owners, providing tranquility of mind when encountered with unforeseen clinical prices. By covering a significant part of vet bills, family pet insurance can aid alleviate the tension that occurs from emergencies, chronic health problems, or mishaps that call for prompt attention.

Understanding the essentials of pet insurance involves recognizing its core parts, including premiums, deductibles, and repayment prices. Costs are the yearly or month-to-month payments called for to keep protection. Deductibles, on the various other hand, are the out-of-pocket sets you back that pet dog proprietors need to pay prior to the insurance plan begins to supply insurance coverage. Repayment prices identify the portion of eligible expenditures that the insurance firm will certainly cover after the insurance deductible is met.

Being notified regarding these aspects enables family pet owners to make audio decisions when choosing a policy that lines up with their economic situations and their animals' health needs. Inevitably, comprehending the principles of animal insurance policy can empower animal proprietors to protect their fuzzy companions while successfully handling vet expenses.

Sorts Of Animal Insurance Plans

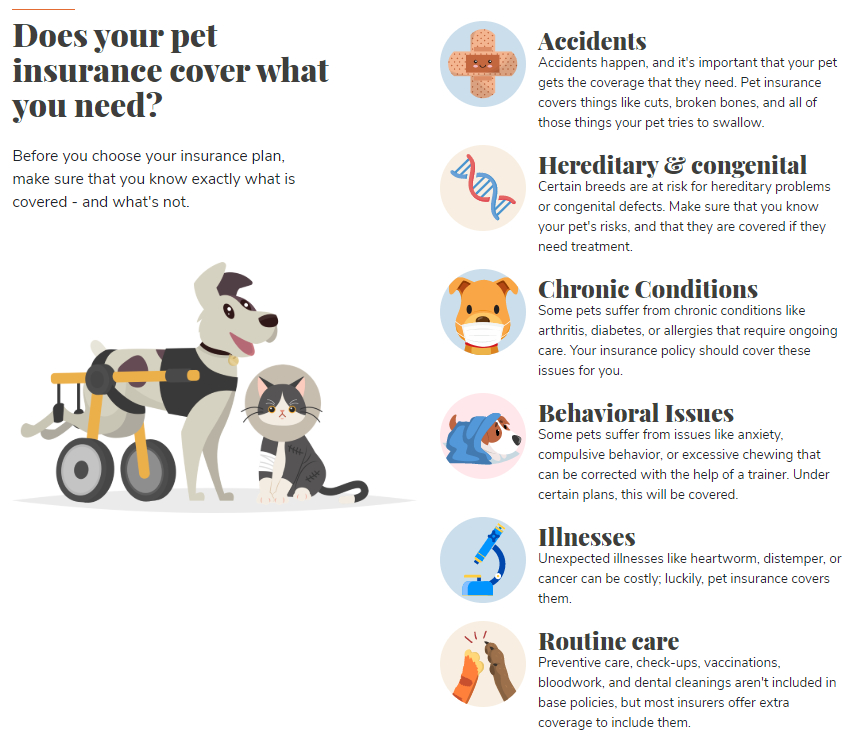

Animal insurance policy prepares been available in different kinds, each created to fulfill the diverse demands of animal owners and their pet dogs. One of the most common kinds consist of accident-only plans, which cover injuries resulting from mishaps but leave out illnesses. These strategies are typically more budget-friendly, making them appealing for those seeking fundamental coverage.

Thorough plans, on the various other hand, provide a wider range of coverage by incorporating both ailments and crashes. This kind of plan generally consists of arrangements for numerous vet services, such as diagnostics, surgical treatments, and prescription medicines, hence supplying even more extensive financial protection.

Another choice is a health or preventive care plan, which concentrates on regular health care (Insurance). These plans frequently cover vaccinations, annual check-ups, and oral cleansings, aiding family pet owners in taking care of preventive care costs

Finally, there are adjustable plans that enable pet proprietors to customize insurance coverage to their details demands, enabling them to select deductibles, compensation rates, and additional advantages. Recognizing these various sorts of pet insurance coverage plans permits pet dog owners to make educated choices, guaranteeing they select the best suitable for their beloved friends.

Cost Contrast of Vet Treatment

When examining the financial facets of pet ownership, an expense comparison of vet care comes to be crucial for accountable family pet guardians. Vet expenses can differ substantially based on the type of care required, the place of the veterinary clinic, and the details demands of the family pet.

For example, treatment for typical conditions like ear infections might set you back in between $200 and $400, while more you could look here major conditions, such as diabetes or cancer cells, could cause costs going beyond $5,000 over time. Furthermore, diagnostic procedures, including X-rays and blood examinations, additionally add to the general price burden.

Contrasting vet costs throughout different clinics and understanding the kinds of services supplied can assist family pet proprietors make notified decisions. This comparison not just help in budgeting for anticipated expenditures but also prepares guardians for prospective emergency scenarios, highlighting the relevance of monetary planning in pet possession.

Exactly How Insurance Policy Reduces Financial Anxiety

Browsing the intricacies of veterinary expenses can be frustrating for pet dog proprietors, particularly when unexpected health concerns develop. The monetary burden of emergency therapies, surgical procedures, or persistent problem monitoring can swiftly escalate, resulting in substantial stress and anxiety for family members currently dealing with the psychological toll of their family pet's ailment. Pet dog insurance policy functions as a beneficial monetary safeguard, enabling animal proprietors to concentrate on their pet's well-being rather than the placing costs of treatment.

In addition to safeguarding versus big, unanticipated expenses, pet insurance can urge regular veterinary treatment. Pet proprietors are more probable to seek preventative treatments and routine examinations, recognizing that these prices are partially covered. Consequently, this aggressive strategy can lead to better wellness results for animals, inevitably improving the bond in between pet dog and owner while relieving monetary stress and anxiety.

Making the Many of Your Policy

Optimizing the advantages of your family pet insurance coverage needs a informed and proactive approach. Begin by completely recognizing your policy's terms, including insurance coverage restrictions, exemptions, and the cases procedure. Familiarize yourself with the waiting periods for particular problems, as this understanding can aid you browse prospective insurance claims properly.

Following, maintain comprehensive documents of your pet's case history, including inoculations, therapies, and any pre-existing problems. When unanticipated vet costs develop., this documentation can help with smoother insurance claims and make sure that you get the protection you're entitled to.

On a regular basis examine your policy to see this website ensure it lines up with your animal's advancing health and wellness needs. Insurance. As your pet ages or if they create persistent problems, take into consideration changing your coverage to give sufficient protection versus rising prices

Last but not least, communicate openly with your veterinarian concerning your insurance policy plan. They can help you comprehend which therapies are covered linked here and guide you in making notified choices for your family pet's health, ultimately boosting the worth of your insurance coverage.

Verdict

In conclusion, animal insurance coverage serves as a beneficial economic device for pet owners, efficiently mitigating the expenses connected with vet treatment. Ultimately, family pet insurance policy represents a proactive technique to responsible family pet possession.

Pet insurance policy serves as a critical economic tool for pet dog proprietors, dealing with the unforeseeable nature of vet expenditures. Family pet insurance serves as an economic safety and security web for pet dog proprietors, offering peace of mind when encountered with unexpected clinical expenses.Pet dog insurance prepares come in various kinds, each created to satisfy the diverse needs of animal proprietors and their animals. Family pet insurance serves as an important financial safety and security internet, permitting pet owners to focus on their family pet's health rather than the installing prices of treatment.

In final thought, animal insurance policy serves as a valuable monetary device for pet dog owners, properly mitigating the expenses associated with veterinary treatment.

Report this page